A primer on the explosive growth of cryptocurrency, how it works and where it’s headed…

For the past 3-4 years, cryptocurrencies have broken out of their collective bubbles, and burst onto the international stage. In almost every country on Earth, people are constantly talking about and, in many cases, buying, trading or selling in cryptocurrency. What used to be a selective group of investors eyeing a new market has accelerated astronomically into a $2 trillion market, making it almost 46,000x bigger than the market cap of the entire stock market. Cryptocurrency, in fact, has gotten so big that now government and federal regulators like the Securities and Exchange Commission are worried there’s not enough oversight – which might mean they’ll eventually want a piece of the digital currency pie, too, as a source of tax revenue. Reports CNBC …

“Certain rules related to crypto assets are well settled. The test to determine whether a crypto asset is a security is clear,” he said. “There are some gaps in this space, though: We need additional congressional authorities to prevent transactions, products and platforms from falling between regulatory cracks. We also need more resources to protect investors in this growing and volatile sector.”

Gensler, who previously taught classes about blockchain and other financial technology at the Massachusetts Institute of Technology, has asked lawmakers to grant his agency the legal authority to oversee crypto exchanges.

He said many of the crypto coins were trading like assets and should fall under the purview of the SEC, which already has significant authority over digital assets.

Recently, cryptocurrency controversy overtook debate on Capitol Hill since policymakers couldn’t agree on cryptocurrency tax laws inside the Infrastructure bill currently before Congress. Most of the disagreement stemmed from federal lawmakers finding themselves completely baffled by the vastness of blockchain and cryptocurrency technology, as well as the philosophy and language. Granted: The cryptocurrency “atmosphere” is very confusing, and even the small-time investor can get lost in the mystical galaxy we’ll call “The Cryptoverse”.

Crypto: Just the Two of Us

Cryptocurrencies are essentially digital currencies or “tokens” that can be exchanged between people online.

Bitcoin, a specific form or brand of cryptocurrency (indeed, it’s currently the most popular) could be compared and equated to digital gold – Ethereum as digital Euro, Dogecoin as a digital Peso, and so on with alternative or “Alt Coins” compared to Bitcoin. These digital currencies are called “Crypto-Currencies,” due to the fact they are dollars encrypted through cryptography, which is according to Kapersky …

…. the study of secure communications techniques that allow only the sender and intended recipient of a message to view its contents.

This basically means that only two people know about the exchange: you and the person you are exchanging cryptocurrency with and what you are exchanging cryptocurrency for.

The Need for a Blockchain

The father of cryptocurrencies is called Bitcoin, which was first created after the financial crash of 2008 by an enigma named “Satoshi Nakamoto”. This first cryptocurrency was, in part, created as a response to the overwhelming amount of people losing faith in the financial system, due to banks printing too much money and the ensuing collapse resulting in hyperinflation. Satoshi, in his announcement of Bitcoin in late 2008, mentioned that he was developing “A Peer-to-Peer Electronic Cash System.”

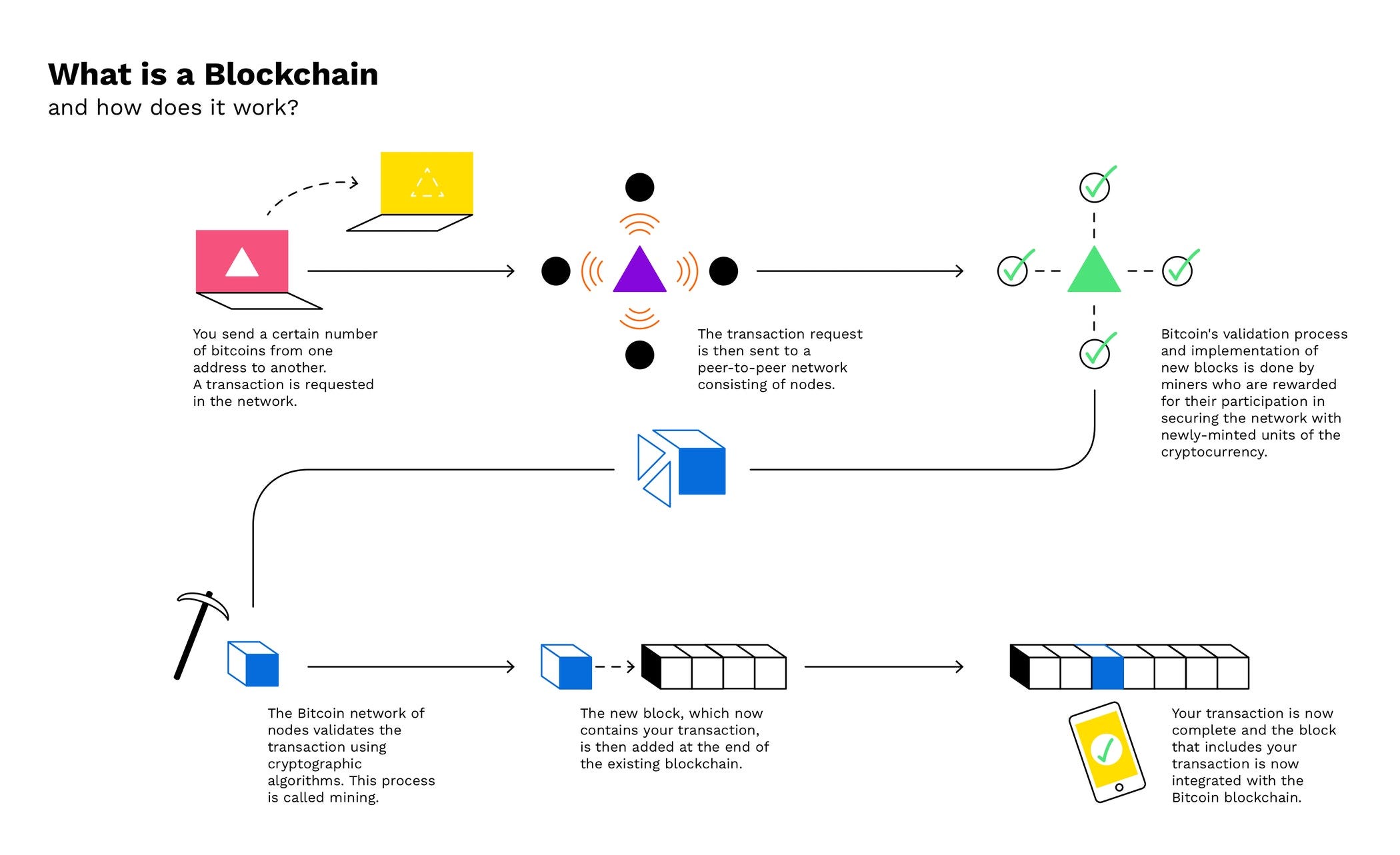

This system would use a peer-to-peer network to prevent double-spending (which is when a hacker steals the currency) and would be completely “decentralized” with no server or central authority. By being decentralized, this meant that there would be no central network, bank, or government in control of this system. By Peer-to-Peer, it is meant that all cryptocurrency that is exchanged is done directly between the people involved, without interference from a central authority like a bank.

The problem here was that digital currencies, unlike physical ones, could easily be replicated and manipulated, due to there being no central authority to verify the authenticity of the coin, and there was no physical exchange of digital currencies where each exchanger can verify the authenticity with their own eyes. Satoshi solved this problem with a system called the “Blockchain”. The blockchain is essentially a digital ledger or database, tracking all cryptocurrency transactions, while verifying the authenticity of each coin transaction. A blockchain differs from a traditional database in that a regular database stores information on multiple servers, where the data is stored in tables. A blockchain stores and collects data (or a record of coin transactions) in groups known as “blocks”. Once this block is filled, it is “chained” to its predecessor block, and the same goes for the blocks that come after it. This results in a literal blockchain.

One might ask, how is cryptocurrency known as untraceable when there is a transaction ledger? The answer to this is that the blockchain’s purpose is to authenticate transactions, while still encrypting them. So even though the transaction is recorded at the time it is made, the people who are involved in the transaction remain unknown, where those people are remains unknown, and what they may have been trading cryptocurrency for remains unknown. The blockchain is mostly used to record and authenticate transactions, but also can keep records of legal contracts, product inventories, original videos, art, and etc. Since the blockchain is secure and provides assurance of 100 percent authenticity, these other usages fit perfectly. Their original form is stored forever on the blockchain, cannot be destroyed or manipulated, and can be accessed from places physical forms and/or copies cannot be accessed from.

PoW & PoS … But, Not What You Think

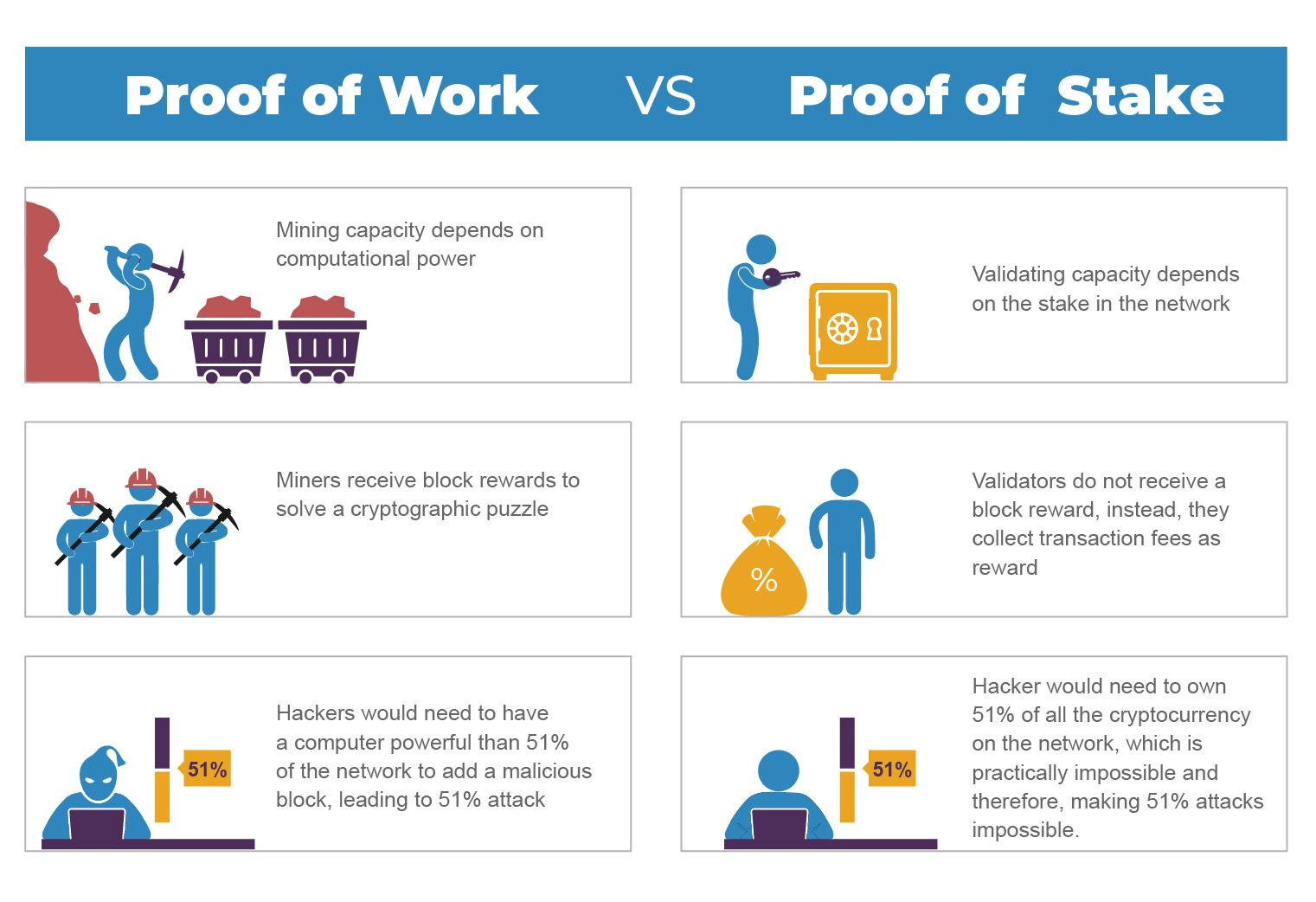

Since the Blockchain is decentralized, there is no central server that tracks and authenticates transactions. So for the new transaction to get verified, each entity (person holding cryptocurrency) needs to have a list of all transactions to make sure whether future transactions are valid or fraudulent. This is done by either of two processes called: Proof of Work (PoW) and Proof of Stake (PoS).

Proof of Work is usually the system used by the first generation and some second generation cryptos, such as Bitcoin, Ethereum (which is moving to PoS), Litecoin, Dogecoin, and etc. Proof of Work means that for more coins to come into circulation and for new transactions to be verified, miners have to use energy, computing power, and many other things to mine blocks (Let’s call them the rocks hiding the gold) in the blockchain (We’ll call this the gold mine). As we know, the energy consumption for mining anything in general is extremely high, which is bad for our environment and climate. These cryptos that use PoW are the ones most people are concerned about.

Next, we have Proof of Stake. Proof of Stake is essentially a cryptocurrency savings account. Instead of mining new blocks (rocks) in the blockchain (gold mine) to add new coins (gold) into circulation, crypto holders put their crypto in a staking account through some cryptocurrency exchange or other provider, and earn an APY (interest rate or Average Percentage Yield) on their holdings. The higher amount of coins gets more coins once they are added in circulation. Usually these people form groups, as the more coins staked = more rewards or more coins.

The same way people form teams and add their computing power together to mine more Bitcoin and add their crypto into a pool. Since they have a high amount of coins for this team, each person gets a percentage of the new coins added into circulation, usually around 7 percent. Staking essentially works the same way as mining when it comes to validating new transactions, just without the energy consumption. Most of the newer generation cryptos such as Cardano, Shiba Inu, Polygon, and other Alt Coins are PoS.

Now, within the cryptoverse, there is growing opposition to PoW and a high demand for cryptos to lower energy consumption through PoS. We’ll explore this divide in future segments on the Cryptoverse. This is all just a basic rundown of the two processes that govern the validation of new cryptocurrency transactions.

To close, cryptocurrency is seen by some as a world as far away as the planet in the movie “Avatar”. The language of this new market is very intricate and very technical in nature. This is the primary reason most government officials and regulators cannot decide on whether to support or oppose the mass-adoption of these digital currencies. The solution to this is for those teaching the basics and fundamentals of cryptocurrency as a way for general populations to understand complex technical and educational terms. Since cryptocurrency is no longer the sole domain of “geeks” and technology hobbyists, it is now very near globalized adoption. The world has shown a high interest in cryptocurrency, and for cryptocurrency to reach mass adoption, must be explained in a way both the computer science professor and the average person can easily comprehend.